Gas prices and

reduced drilling – why? This brief but clear lead-in sentence helps set the

scene for the post that follows:

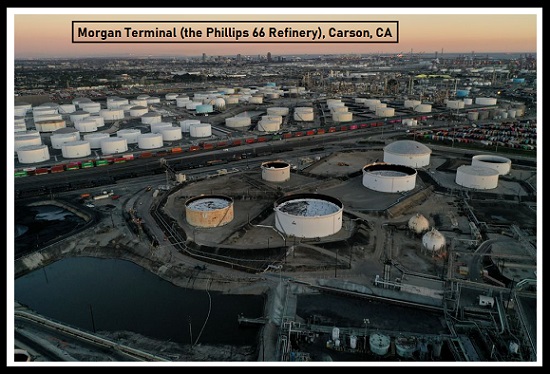

HOUSTON, June 21 (Reuters) – Capacity for U.S. oil refiners fell in 2021 for the second year in a row (as government data shows) as plant shutdowns kept whittling away on their ability to produce gasoline and diesel.

Pump prices, at time of this article) were near $5 a

gallon nationwide as soaring demand for motor fuels collides with the loss of

about 1 million barrels of processing capacity in the last three years due

largely to closings to plants that were unprofitable when fuel demand cratered

at the height of the COVID-19 pandemic.

Now the rest of the

story (as the late great Paul Harvey used to say):

RIGHT UP FRONT ON A COMPLEX ISSUE: The biggest reason oil

production isn’t increasing is that American energy companies and Wall Street

investors are not sure that prices will stay high long enough for them to make

a profit from drilling lots of new wells.

Executives at 141 oil companies surveyed by the Federal Reserve Bank of

Dallas in mid-March offered several reasons why they weren’t pumping more oil:

1. They said they were

short of workers and sand, which is used to fracture shale fields to coax oil

out of rock.

2. Some 60% of the

respondents aid investors don’t want companies to produce a lot more oil,

fearing that it will hasten the end of high oil prices.

FYI INFO:

Refineries shut down in the last 2 years due to CoVID. The result: That reduced

the nation's refining capacity by about 5% percent thus eliminating more than 1

million barrels per day from the market, and that left the remaining facilities

straining to meet demand.

The U.S. still produces more and uses more oil and gas than

any other country confirmed by the Energy Information Administration (EIA).

The U.S. as a top producer, with 18.61 million barrels per

day, is equivalent to 20% of the world supply. As of March 2022 the EIA reports

we an estimated 38.2 billion barrels worth of proven oil reserves

that are still untapped.

But the big impediment to the U.S. using that oil is that it

tends to be lighter and different from the heavier imported oil we currently

rely on for most of our needs.

NOT PRESIDENT BIDEN’S FAULT (CNN reports) – some facts:

· The oil industry can decide to produce more oil

whenever it wants.

· The oil industry already possess more than 9,000

approved — but unused — drilling permits on federal lands.

· Nearly 5,000 of those unused permits to drill were

approved in 2021 – the highest figure since the second Bush administration.

When

government oil leases were offered driller bids went down and none were accepted

– why?

· Most drillers said it was not profitable to

drill.

· Some drillers blamed Wall Street investors for drawing

back.

FYI from CBS news,

Barron’s, and Market Watch: The price of crude oil has been steadily rising

since the start of last year.

It hit $100 a barrel in March after Russia invaded Ukraine — the first time in 12 years it breached three digits. At that price, oil companies would normally race to snap up land and drill new wells. However, a sizable number of oil and gas executives are saying they won't increase production at any price says (ref: Federal Reserve Bank of Dallas). Asked what level the price of West Texas Intermediate oil would need to hit to get publicly traded oil and gas companies back growing, 29% of oil CEO’s said expansion plans weren't dependent on price. Some 10% said a price above $120 a gallon was needed.

My 2 cents: Greed factor not in play over oil production, right? Naw

can’t be that, um. I hope the above info helps in proving that point.

Finally these tidbits: The top 5 oil producers in the world as of 2021:

#1.

United States: 14.5%

#2.

Russia: 13.1%

#3.

Saudi Arabia: 12.1%

#4.

Canada: 5.8%

#5. Iraq: 5.3%

This late breaking news just in from Business Insider: President Joe Biden is reportedly set to release 14

million more barrels of oil from the federal government's Strategic Petroleum Reserve (SPR) which still has now some 400 million barrels in

the originally authorized 714 million barrels.

History of SPR release and other info: The United States started the SPR in 1975 to mitigate future supply disruptions after world oil supplies were interrupted during the 1973–1974 oil embargo crisis caused during the 1973 Arab-Israeli War.

Arab members of OPEC imposed an embargo against the United

States in retaliation for our decision to re-supply the Israeli military

and to gain leverage in the post-war peace negotiations.

Thanks for stopping by

No comments:

Post a Comment